US DOLLAR

Summary - February Trading Overview

The Mini U.S. Dollar Index® Futures (SDX) experienced varied performance throughout February, beginning with a slight decline on the first trading day, closing down by 0.21%. The release of Nonfarm Payrolls data showing an addition of 353,000 new jobs fueled a bullish recovery, leading to the SDX's strongest one-day performance of the month with a gain of 0.88%. This momentum continued into the first week, closing at 103.78, a 0.53% increase.

Subsequent weeks saw fluctuations in demand for the U.S. Dollar, influenced by ISM Services PMI data and Federal Reserve Chair Powell's remarks, leading to sideways trading around key resistance levels. Positive core inflation and CPI data briefly bolstered the SDX, though it encountered resistance, closing the month at 104.10, a gain of 0.98%. This mixed performance underscored a market oscillating between bullish optimism and cautious sideways movement.

MARKET CONDITIONS:

Forward-Looking Outlook - March Predictions

March brings several high-impact events that could significantly influence the SDX's trajectory, including Nonfarm Payrolls, the Consumer Price Index, Retail Sales, and the Federal Reserve's Interest Rate Decision. Historical volatility data suggests a potential price range of 105.76 to 100.84 for the next 31 days, indicating continued market volatility.

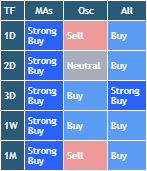

Weekly support and resistance levels identified through AutoUFOs®, at 102.31 to 101.82 and 106.93 to 105.16 respectively, will be crucial for traders planning their strategies. While daily technical indicators show strong buying signals, oscillators present a mixed view, suggesting that waiting for a market pullback could be prudent before initiating trades.

The Broader Economic Context

The performance of the SDX is a barometer for the broader U.S. economic outlook, closely watched for insights into inflationary trends, consumer spending, and the Federal Reserve's monetary policy stance. These factors, combined with global economic conditions, play a pivotal role in shaping market sentiment and the Dollar's value.

In this complex environment, leveraging advanced trading technologies like AutoClimate and AutoUFOs® can provide traders with a competitive edge, enabling nuanced analysis and strategic decision-making.

Conclusion

As we move into March, the SDX market remains at the mercy of both domestic economic indicators and global geopolitical developments. Traders equipped with comprehensive market analysis tools and a keen understanding of upcoming economic events will be well-positioned to navigate this uncertain landscape.

BITCOIN

Market Commentary Overview

February witnessed a remarkable resurgence in Bitcoin futures (BMC), with the price catapulting beyond the $60,000 mark, reaching a pinnacle not observed since November 2021. This surge represented a monumental 45.4% gain from the prior month's closing, underscoring a renewed investor confidence and a bullish momentum within the cryptocurrency market.

The legislative landscape is also evolving, with the United States House of Representatives Financial Services Committee pushing for a framework that allows regulated financial institutions to act as custodians for digital assets. This initiative aims to counterbalance the SEC's Staff Accounting Bulletin 121 (SAB 121), which imposes stringent reporting requirements on digital asset custodians, thereby affecting the operational capacity of financial institutions in the cryptocurrency domain.

MARKET CONDITIONS:

Forward-Looking Insights

The BMC's trajectory into March looks promising yet volatile. The historical volatility metrics—53.56% over 21 days—signal a high degree of price fluctuation, which could see the futures ranging between $50,665 and $72,455 in the forthcoming 31 days. This volatility is reflective of both the inherent unpredictability of the cryptocurrency market and the external legislative developments influencing investor sentiment.

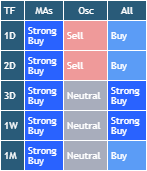

For those navigating the BMC market, attention should be paid to the weekly support ($38,862 to $41,473) and resistance ($63,430 to $68,898) levels. These thresholds, derived from sophisticated analysis tools like AutoUFOs®, provide essential markers for planning strategic entries and exits amidst the anticipated fluctuations.

Image and Context

To accompany this market report, a visual representation of the Bitcoin futures price trend alongside key legislative milestones would provide a comprehensive outlook on the factors influencing BMC's current trajectory.

Broader Market Dynamics

The burgeoning interest in Bitcoin futures is indicative of the broader cryptocurrency market's potential and the increasing institutional acceptance of digital assets. The legislative efforts to integrate digital assets within regulated financial systems underscore a pivotal shift towards mainstream cryptocurrency adoption, promising to redefine the landscape of financial investments.

Conclusion

As we advance, the Bitcoin futures market remains a focal point of interest for both retail and institutional investors. With legislative developments poised to impact market dynamics significantly, staying informed and utilizing advanced trading tools will be crucial for those looking to capitalize on the opportunities presented by the volatile yet lucrative cryptocurrency market.

ASIA TECH

Summary - February Trading Overview

The Micro Asia Tech 30 Index Futures (ATI) showcased a remarkable rebound, registering a gain of 6.2% compared to the year-end close of January. This upswing was buoyed by positive performances across all four Asian equity markets, reflecting a resurgence in investor confidence within the tech sector.

Notably, Chinese tech stocks predominantly closed in positive territory, led by standout performances from companies like Meituan and NetEase, with gains of 27.6% and 16.3%, respectively. This bullish trend was echoed across Taiwan, Japan, and South Korea, with only a few exceptions. The robust growth in tech components underlines the sector's resilience and the increasing influence of Asian tech companies on the global stage.

MARKET CONDITIONS:

Forward-Looking Outlook - March Predictions

As we approach critical economic events, including China's CPI announcement and the PBOC Interest Rate Decision, the ATI's trajectory remains a focal point for investors. Historical and statistical volatility figures suggest continued market activity, with the price expected to fluctuate between $3,278 and $3,698 in the coming month. This anticipated movement highlights the ongoing dynamism within the Asian tech sector, fueled by innovation and regional economic developments.

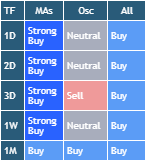

Weekly support and resistance levels, identified through sophisticated analysis techniques such as AutoUFOs®, provide strategic markers for investors. These insights, combined with the neutral stance from technical oscillators, suggest a cautious yet opportunistic approach for market participants.

Broader Market Implications

The ATI's performance is indicative of the broader trends in the Asian technology landscape, where innovation, policy shifts, and global market dynamics intersect. As the region continues to emerge as a pivotal hub for technological advancement, understanding these market movements becomes crucial for investors looking to capitalize on the growth of the Asian tech sector.

The integration of advanced trading tools and keen market analysis, including insights from AutoClimate and AutoUFOs®, can empower investors to navigate this complex and rapidly evolving market landscape with greater precision and confidence.

BRENT

Summary - February Trading Overview

The Mini Brent Crude Futures (BM) showcased a tentative optimism in February, marking a 1.7% increase to close at $81.90. This movement suggests a possible upward trend with BM surpassing the $84 level, sparking discussions on the continuity of an upward momentum in the oil market.

The global oil scene is currently poised on the brink of significant developments, with OPEC+'s ongoing production cuts and geopolitical factors shaping market sentiments. The anticipation of these factors, alongside the supply adjustments by major oil-producing nations and fluctuating demand influenced by economic indicators from China and the United States, plays a crucial role in the future direction of crude prices.

MARKET CONDITIONS:

Forward-Looking Outlook - April to June 2024 Predictions

As the oil market eyes the upcoming 53rd Joint Ministerial Monitoring Committee (JMMC) and the 37th OPEC and non-OPEC Ministerial Meeting (ONOMM), stakeholders are keenly watching for signals that may influence global crude supply dynamics. The balance between voluntary production cuts and global demand concerns continues to drive market speculations.

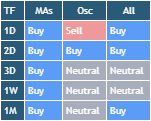

The projected price range for BM, based on historical volatility, indicates a fluctuation between $74.42 and $89.40 over the next 29 days. These potential movements underline the market's sensitivity to geopolitical developments and policy decisions. Weekly support and resistance levels provide critical thresholds for traders, highlighting the importance of strategic planning in response to the evolving market landscape.

Broader Implications and Strategic Considerations

The crude oil market remains a focal point of global economic health, with its performance directly impacting a range of sectors. The intricate balance between supply and demand, influenced by geopolitical events, policy decisions, and economic indicators, underscores the complexity of trading in this vital commodity.

Advanced trading tools and market analysis techniques, such as AutoUFOs®, become indispensable for navigating the volatile crude market. These tools offer nuanced insights that can empower traders to make informed decisions amidst the market's inherent unpredictability.

Please note that this report provides an overview of the market conditions and does not constitute financial advice. It is recommended that individuals seek the guidance of a qualified financial professional before making any investment decisions.

Please feel free to join our ˲tradewithufos community, we provide comprehensive trading courses and trading apps.

Apps for market analysis and trading:

www.tradewithufos.com/apps

FREE forever membership for everyone:

www.tradewithufos.com/membership

TRADDICTIV · Research Team