US DOLLAR

Summary - January Trading Overview

The Mini U.S. Dollar Index® Futures (SDX) showcased a promising start to 2024, rallying in the opening days and closing the month with a gain of 2.04%, indicating a robust demand for the U.S. Dollar. Despite facing resistance and trading sideways during certain periods, the SDX managed to sustain its momentum, especially following key economic releases such as Nonfarm Payrolls and Core Inflation data. The index closed January at 103.09, reflecting a positive market sentiment and adapting to the economic indicators released throughout the month.

The period saw the SDX navigating through various resistance levels, with a significant rally spurred by the demand for the U.S. Dollar, culminating in a peak at 103.37. This performance sets a cautiously optimistic tone for the U.S. Dollar amidst upcoming economic events and data releases.

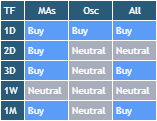

MARKET CONDITIONS:

Forward-Looking Outlook - February Predictions and Beyond

February holds several high-impact events that could influence the SDX's trajectory, including the Consumer Price Index, Retail Sales data, FOMC Minutes, and preliminary GDP figures. The historical volatility suggests potential price movements between 105.76 to 100.84 over the upcoming month. Market participants should consider the identified weekly support (102.31 to 101.82) and resistance (106.93 to 105.16) levels for strategic planning, based on the sophisticated analysis provided by tools like AutoUFOs®.

The daily timeframe indicates a shift towards an uptrend, contrasted with a maintained downtrend on the weekly timeframe, suggesting a market at a potential inflection point. Investors and traders are advised to stay vigilant, especially around the times of major economic announcements.

Broader Economic Context

The SDX's performance is a reflection of the broader economic landscape, influenced by inflation rates, Federal Reserve policies, and global market dynamics. As such, it serves as a barometer for investor sentiment towards the U.S. Dollar, influenced by domestic and international economic developments.

Understanding these broader economic indicators is crucial for navigating the financial markets effectively. Utilizing advanced analytical tools like AutoClimate can provide deeper insights into the prevailing market trends and help anticipate future movements.

Conclusion

In conclusion, the Mini U.S. Dollar Index® Futures market is poised for an interesting February, with the SDX showing signs of an uptrend on the daily timeframe. The upcoming economic events will likely play a significant role in determining the direction of the U.S. Dollar. For market participants, employing a comprehensive analytical approach and staying updated on economic developments will be key to navigating the expected volatility.

BITCOIN

Summary - Recent Market Developments

Bitcoin futures (BMC) experienced a slight pause in their upward momentum as the market absorbed the SEC's landmark approval of nine spot bitcoin exchange-traded funds (ETFs) in the United States. Despite reaching towards the $40,000 level early in the month, BMC closed at $42,342, marking a minor decrease of 1.7% from the previous month. This movement reflects the market's cautious optimism and the significant impact of regulatory developments on the digital asset landscape.

The approval of spot bitcoin ETFs has been a pivotal moment for the cryptocurrency market, potentially heralding a new era of institutional participation and investment in digital assets. The increase in bitcoin holdings by these ETFs underscores the growing acceptance and legitimacy of cryptocurrencies as an investment class.

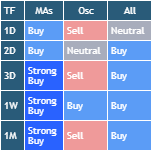

MARKET CONDITIONS:

Forward-Looking Outlook - Anticipating Market Movements

The market anticipates further developments, particularly with the upcoming bitcoin halving event in April 2024, which historically has been a catalyst for price movements. The historical volatility suggests a wide potential price range in the coming days, with investors and traders closely watching support and resistance levels to gauge market sentiment and plan their strategies accordingly.

The SEC's approval of spot bitcoin ETFs introduces a new dynamic into the market, potentially increasing liquidity and attracting a broader base of investors. This development, coupled with the anticipation surrounding the bitcoin halving event, sets the stage for a potentially volatile and eventful period in the cryptocurrency market.

Broader Crypto Market Dynamics

The performance of BMC is indicative of broader trends in the cryptocurrency market, which continues to evolve rapidly in response to regulatory developments, technological advancements, and shifts in investor sentiment. The approval of spot bitcoin ETFs represents a significant milestone, reflecting growing regulatory clarity and acceptance of digital assets.

Understanding these broader market dynamics is crucial for participants in the cryptocurrency market. Advanced tools and analytical frameworks can provide valuable insights into market trends, helping investors navigate the complexities of cryptocurrency trading and investment.

Conclusion

In conclusion, the BMC market is at a pivotal juncture, with recent regulatory approvals and upcoming events poised to influence market dynamics significantly. For market participants, staying informed and adaptable will be key to navigating the expected volatility and capitalizing on potential opportunities in the evolving landscape of cryptocurrency futures.

ASIA TECH

Summary - January Performance Overview

The Micro Asia Tech 30 Index Futures (ATI) faced a challenging start to the year, ending January 4.1% lower compared to the December year-end close. The index's performance was notably impacted by significant weaknesses in the Chinese equity markets, with major tech stocks experiencing considerable declines.

The downturn in Chinese tech stocks, including major falls in companies like Sunny Optical Technology and Bilibili, contrasted sharply with the positive movements seen in Japanese tech components, which all posted gains for the month. This mixed performance across the Asian tech landscape underscores the varying factors influencing each market segment.

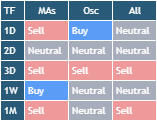

MARKET CONDITIONS:

Forward-Looking Outlook - February Predictions and Market Dynamics

The upcoming high-impact events, including China's CPI, the PBOC Interest Rate Decision, and Manufacturing & Non-Manufacturing PMI, are poised to influence ATI's direction in February. The historical volatility suggests potential price movements, with investors and traders closely watching the identified weekly support and resistance levels for strategic decision-making.

The stark contrast between the performances of Chinese and Japanese tech stocks highlights the diverse impacts of market conditions across the Asian tech sector. This disparity underscores the importance of a nuanced approach to investing in this volatile and rapidly evolving market.

Broader Market Context

The performance of ATI reflects broader trends in the Asian technology sector, influenced by regulatory changes, economic indicators, and global market dynamics. Understanding these broader dynamics is crucial for navigating the complexities of the Asian tech market effectively.

Advanced analytical tools and frameworks can provide valuable insights into market trends, aiding investors and traders in making informed decisions. As the market continues to evolve, staying informed and adaptable will be key to navigating the expected volatility.

Conclusion

In conclusion, the Micro Asia Tech 30 Index Futures market faces a complex landscape, with varied performances across its components highlighting the challenges and opportunities within the Asian tech sector. For market participants, employing comprehensive market analysis and staying updated on economic developments will be crucial in navigating the anticipated market movements in February and beyond.

BRENT

Summary - Recent Market Trends and OPEC Decisions

Mini Brent Crude Futures (BM) experienced an upward trend for most of the recent month, aiming for the $84 level, and eventually closed at $80.55, marking a 4.6% increase. The OPEC's 52nd Meeting of the Joint Ministerial Monitoring Committee (JMMC) reaffirmed members' adherence to production cuts, highlighting the group's ongoing efforts to stabilize the market.

The United States Federal Reserve's decision to maintain interest rates added another layer of influence, potentially boosting economic growth and, by extension, oil demand. This backdrop set the stage for BM's performance, amidst global economic shifts and policy decisions that continue to shape the energy market landscape.

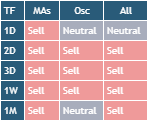

MARKET CONDITIONS:

Forward-Looking Outlook - Anticipating Future Movements

The upcoming 53rd JMMC and the 37th ONOMM meetings are key events on the horizon, with the potential to impact global oil markets significantly. The historical volatility indicates potential price movements between $71.90 to $89.20 over the next month. Market participants are closely monitoring these developments, alongside weekly support and resistance levels, to inform their trading strategies.

The interplay between OPEC's production decisions and global economic policies, including interest rate adjustments, underscores the complex dynamics at play in the oil markets. These factors, combined with technical indicators, provide insights into potential market directions and opportunities.

Broader Market Context

The performance of BM is indicative of broader trends in the global energy market, influenced by geopolitical events, supply-demand dynamics, and policy decisions by major oil-producing nations and economic blocs. Understanding these broader dynamics is crucial for market participants, offering a strategic advantage in navigating the volatile energy sector.

Advanced tools and analytical frameworks can offer valuable insights into these trends, aiding investors and traders in making informed decisions. As the market continues to evolve, staying informed and adaptable will be key to navigating the expected volatility.

Conclusion

In conclusion, the Mini Brent Crude Futures market is at a pivotal juncture, with recent trends and upcoming OPEC meetings poised to influence market dynamics significantly. For market participants, employing sophisticated analysis tools and staying abreast of global developments will be crucial in navigating the complexities of the oil market.

Please note that this report provides an overview of the market conditions and does not constitute financial advice. It is recommended that individuals seek the guidance of a qualified financial professional before making any investment decisions.

Please feel free to join our ˲tradewithufos community, we provide comprehensive trading courses and trading apps.

Apps for market analysis and trading:

www.tradewithufos.com/apps

FREE forever membership for everyone:

www.tradewithufos.com/membership

TRADDICTIV · Research Team