US DOLLAR

Summary - March Trading Overview

The Mini U.S. Dollar Index® Futures (SDX) navigated through March with fluctuating momentum, ultimately securing a modest gain of 0.16% to close at 104.27. The month kicked off on a softer note, influenced by negative economic data that dampened demand for the U.S. Dollar, marking a decline of 0.29% on the first trading day. The subsequent weeks saw further volatility, highlighted by a significant drop following the ADP Employment Change and a bearish phase that culminated with the Nonfarm Payrolls release. Despite surpassing expectations, an uptick in the unemployment rate to 3.9% added to the bearish sentiment.

However, the tide began to turn mid-month, buoyed by positive Retail Sales data and a stable interest rate decision by the Federal Reserve, which held the federal funds rate between 5.25% and 5.50%. These developments contributed to a rebound in the U.S. Dollar, showcasing the dynamic interplay between economic indicators and currency value.

MARKET CONDITIONS:

Forward-Looking Outlook - April Predictions

Looking ahead to April, the SDX's trajectory will be keenly influenced by several high-impact economic events, including Nonfarm Payrolls, CPI, Retail Sales, and the preliminary GDP report. These indicators will play a pivotal role in shaping market sentiment and the Dollar's standing on the global stage.

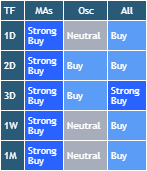

Technical analyses suggest a continued bullish trend on both daily and weekly timeframes, with strong buy signals based on moving averages. However, the market's neutral stance, as indicated by technical oscillators, suggests potential for volatility and underscores the importance of strategic positioning in anticipation of economic updates.

The projected price range, based on historical volatility, hints at continued fluctuations with a possibility of reaching between 106.04 to 102.51 in the coming month. This underscores the need for investors and traders to closely monitor weekly support and resistance levels, which could serve as crucial markers for planning market entries and exits.

Broader Implications and Strategic Insights

The performance of the SDX is a barometer for the broader economic health of the United States, reflecting the intricate relationship between monetary policy, economic data, and global financial markets. As such, the coming month's economic events are not just pivotal for traders of the SDX but also offer broader insights into the U.S. economy's direction.

Advanced analytical tools like AutoUFOs® provide an edge in deciphering market trends, enabling traders to navigate the complexities of currency futures with greater confidence. As we move into a month brimming with significant economic announcements, the ability to interpret and react to market signals will be paramount.

BITCOIN

Summary - Recent Trading Performance

The Bitcoin futures (BMC) market has witnessed a significant rally, with prices surging past the $70,000 mark to close at $71,472. This impressive 16.1% gain from the previous month underscores the growing investor enthusiasm as the market anticipates the upcoming bitcoin halving event in April 2024. The halving, which will reduce the miner reward from 6.25 bitcoins to 3.125 bitcoins, is a pivotal event that historically correlates with substantial increases in Bitcoin's value.

This anticipation is grounded in the pattern observed after previous halvings in 2012, 2017, and 2020, where Bitcoin's price notably surged in the months following the event. As such, the market's current momentum reflects a blend of speculative interest and strategic positioning ahead of this significant milestone in the Bitcoin ecosystem.

MARKET CONDITIONS:

Forward-Looking Outlook - April 2024 and Beyond

With the halving event drawing closer, the Bitcoin futures market is poised for potential volatility and significant interest from both long-term investors and speculative traders. Historical volatility indicators suggest a wide price range possibility in the next 34 days, stretching from $56,825 to $86,120, underscoring the market's anticipation of the halving's impact.

Investors and traders considering positions in BMC futures might look to the weekly support area at $50,850 to $52,670 as a strategic point for planning entries or exits. Such levels are instrumental in navigating the expected fluctuations and capturing opportunities arising from the market's dynamics.

Strategic Considerations and Market Dynamics

The upcoming halving event not only symbolizes a reduction in Bitcoin's supply rate but also highlights the cryptocurrency's deflationary nature. This aspect, combined with increasing adoption and recognition of Bitcoin as a store of value, suggests a bullish outlook for the digital asset in the medium to long term.

For market participants, leveraging advanced analytical tools and staying informed about global economic indicators and cryptocurrency-specific developments will be crucial. The intersection of technical analysis, historical market patterns, and emerging trends in the blockchain space will guide strategic decision-making in the Bitcoin futures market.

ASIA TECH

Summary - First Quarter Performance

The Micro Asia Tech 30 Index Futures (ATI) illustrated robust growth throughout the first quarter, culminating in a significant 7.1% increase over the prior month and a remarkable 9.0% growth for the quarter. This upward trend reflects the dynamic and evolving nature of the Asian tech sector, buoyed by substantial gains across major Chinese tech stocks, including Meituan and JD.com, which soared by 21.3% and 21.2%, respectively.

Notably, the performance was mixed across the board, with Taiwanese stocks showing strong upward momentum led by Hon Hai Precision Industry's substantial 45.6% jump. In contrast, certain stocks like Sunny Optical Technology and NetEase saw declines, showcasing the volatile yet promising nature of the tech industry in the region.

MARKET CONDITIONS:

Forward-Looking Outlook - Upcoming Economic Events

As we move into the next quarter, the ATI's trajectory will be closely watched, with several key economic indicators on the horizon, including China's CPI, the PBOC Interest Rate Decision, and Manufacturing PMI reports. These events are expected to shed light on the economic health of the region and potentially influence the direction of the tech market.

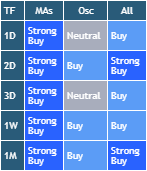

Technical analysis suggests continued strong buying market conditions, supported by both daily and weekly moving average indicators. The market's response to the upcoming economic events will be crucial, with historical volatility indicating a potential price range movement between $3,501 to $3,969 in the near term.

Broader Market Implications and Strategic Insights

The Asian tech sector remains at the forefront of innovation and growth, with its influence extending beyond regional markets to shape global technological trends. The diverse performance across various stocks underscores the importance of strategic market analysis and the use of sophisticated tools like AutoUFOs® for identifying potential trading opportunities.

Investors and traders are advised to keep a close watch on the upcoming high-impact events and adjust their strategies accordingly to navigate the anticipated market fluctuations. The blend of traditional beauty and modern technological advancement within Asia's iconic cityscapes mirrors the dynamic and vibrant nature of its tech industry, promising exciting opportunities for market participants.

BRENT

Summary - Market Dynamics Amidst Geopolitical Tensions

The Mini Brent Crude Futures (BM) navigated through a month marked by significant geopolitical events and shifts in global oil dynamics. The market witnessed an initial downturn in the first eight trading days, followed by a rebound that culminated in a 6.2% increase, closing the month at $87.00. Notably, the drone attack on Russia's Taneco oil refinery by Ukraine aimed at curtailing Russia's war funding underscored the geopolitical risks that loom over the global oil market.

The United States' strategic move to escalate oil exports by 13% in 2023, primarily to European countries and India, reflects a broader effort to diversify global energy supplies away from Russia and traditional OPEC nations. This shift not only influences global oil flow but also represents the intricate interplay between energy policies and geopolitical strategies.

MARKET CONDITIONS:

Anticipated Movements and Strategic Insights

As we approach the 53rd Joint Ministerial Monitoring Committee (JMMC) and the 37th OPEC and non-OPEC Ministerial Meeting (ONOMM), the market's focus intensifies on the potential implications for global oil supply and pricing strategies. The anticipation of continued voluntary production cuts and their impact on the market will be critical areas of interest for investors and traders alike.

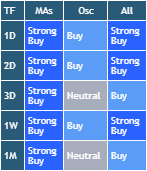

Technical analyses suggest a bullish market sentiment, supported by strong buying signals from daily technical indicators and a buying state indicated by technical oscillators. The projected price range, based on historical volatility, suggests a fluctuation between $80.36 and $93.64 in the near term, underscoring the market's response to geopolitical events and supply-demand dynamics.

Navigating the Global Oil Market Landscape

The current state of the global oil market underscores the significance of geopolitical events and their cascading effects on supply chains, pricing, and international relations. The strategic positioning of nations, alongside the pivotal role of OPEC+ in steering the market's direction, highlights the complex dynamics that market participants must navigate.

Investors and traders are advised to closely monitor upcoming high-impact events, leveraging advanced analytical tools and insights to navigate the evolving market landscape. The interconnectedness of global events, the volatility of oil prices, and strategic national moves underscore the critical importance of informed decision-making in the oil futures market.

Please note that this report provides an overview of the market conditions and does not constitute financial advice. It is recommended that individuals seek the guidance of a qualified financial professional before making any investment decisions.

Please feel free to join our ˲tradewithufos community, we provide comprehensive trading courses and trading apps.

Apps for market analysis and trading:

www.tradewithufos.com/apps

FREE forever membership for everyone:

www.tradewithufos.com/membership

TRADDICTIV · Research Team