US DOLLAR

Summary:

The Mini U.S. Dollar Index® Futures (SDX) experienced a dynamic October, with the market initially showcasing bullish behavior. The demand for the U.S. Dollar rose sharply, pushing the SDX to a new high for 2023 at 106.72. However, this momentum was short-lived as bearish trends took over, influenced by various economic factors and geopolitical tensions. Notably, the release of positive Nonfarm Payrolls data failed to sustain the bullish trend, and the SDX concluded the month at 105.80, marking a slight loss of 0.02%.

This fluctuation in the Dollar's value can be attributed to several key factors, including market reactions to Federal Reserve policies, global economic uncertainties, and shifts in investor sentiment. The performance of the SDX serves as a critical indicator for traders and investors, highlighting the importance of real-time market analysis and the utilization of advanced trading tools like AutoClimate and AutoUFOs, which offer invaluable insights for strategic decision-making.

MARKET CONDITIONS:

As we delve into November, the focus shifts to upcoming high-impact events such as the Consumer Price Index and Retail Sales data. These events are likely to influence the market significantly. The SDX's historical volatility figures, with a 21-day volatility at 6.78%, suggest potential price movements. The forecasted range, based on the prior month's close, is between 108.65 to 104.48, indicating a possible continuation of the market's volatility.

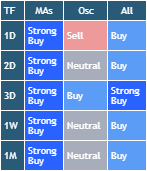

Investors and traders might want to pay close attention to weekly support (104.19 to 102.89) and resistance (110.64 to 112.95) levels. These critical thresholds, determined using tools like AutoUFOs, provide a clearer picture of potential entry and exit points in the market. The current neutral conditions, as indicated by technical oscillators, also suggest a cautious approach, with the possibility of a pullback offering opportunities for both buying and selling.

The SDX's performance in the coming month will largely depend on global economic trends, monetary policies, and investor sentiment. The use of advanced trading technology, including predictive tools like AutoClimate, can offer traders a competitive edge in navigating these uncertain waters.

The Broader Context

Understanding the broader financial market is essential for comprehending the dynamics of the Mini U.S. Dollar Index® Futures. In the current economic landscape, characterized by rising inflation and interest rate hikes, the value of the U.S. Dollar is more volatile than usual. This volatility is not just a challenge but also an opportunity for savvy traders who leverage cutting-edge tools and stay informed about market trends.

In conclusion, the Mini U.S. Dollar Index® Futures market appears to be at a crucial juncture, with various global events poised to shape its direction. By employing robust analysis tools like AutoClimate and AutoUFOs and staying abreast of key economic indicators, traders can navigate these uncertain waters with greater confidence and strategic foresight.

BITCOIN

Summary:

The BMC witnessed a significant shift in October, breaking past the $32,000 barrier, a level it hadn't surpassed since April 2003. Closing the month at $34,687, a substantial 27.5% increase from the previous month's close, the Bitcoin futures contract showcased remarkable resilience and investor confidence. The key to sustaining this uptrend will be maintaining closes above the $25,000 mark and establishing higher lows.

The rise of companies like Zodia Custody, backed by giants such as Standard Chartered Bank, Northern Trust, and SBI Holdings, highlights the growing institutional interest in digital assets. Their expansion into markets like Hong Kong, known for its robust demand for digital assets, underlines the evolving landscape of cryptocurrency investments and the need for secure digital asset infrastructure.

MARKET CONDITIONS:

As we approach the end of 2023, the BMC’s trajectory is crucial for investors. The high historical volatility, noted at 53.64% for the 21-day range, suggests a potential for considerable price fluctuations. With a projected range between $29,315 to $40,057 for the next 30 days, the market could witness significant movements.

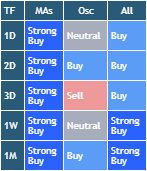

For traders employing strategies around Bitcoin futures, the weekly support levels at $26,065 to $27,267, and resistance levels at $38,122 to $47,320, should be closely monitored. These levels, identified using advanced tools like AutoUFOs®, provide critical insights for planning market entries and exits. The mixed market conditions, as indicated by technical oscillators, underscore the need for a nuanced approach to trading in this volatile market.

The Broader Crypto Market Context

Understanding the dynamics of Bitcoin futures requires a broader view of the cryptocurrency market. The sector is evolving rapidly, with institutional players increasingly becoming involved. Companies like Zodia Custody represent the intersection of traditional finance and the burgeoning digital asset market, highlighting the growing acceptance and integration of cryptocurrencies in mainstream finance.

Moreover, the anticipated Bitcoin halving event in April 2024 adds another layer of complexity and potential volatility to the market. This event, historically associated with price surges, could significantly impact the BMC’s performance in the coming months.

Conclusion

In summary, the BMC market is at an intriguing crossroads. The integration of traditional financial institutions into the digital asset market, combined with upcoming high-impact events like the Bitcoin halving, creates a unique investment landscape. For traders and investors looking to navigate these waters, leveraging sophisticated analysis tools like AutoClimate and AutoUFOs® could prove invaluable, providing the edge needed to make informed decisions in a market as unpredictable as cryptocurrency.

ASIA TECH

Summary:

The Micro Asia Tech 30 Index Futures (ATI) had a challenging October, following a broader weak performance trend in global equity markets. The index set another lower high below $3,250 and a lower low around $3,000, eventually closing the month at $3,019 — 4.0% lower compared to September. This movement reflects the volatility and uncertainty prevalent in the Asian tech sector.

Notably, the mixed performance among Chinese component stocks significantly impacted the index. While Sunny Optical Technology and Xiaomi Corp showed impressive gains, other major players like Baidu and Kuaishou Technology experienced sharp declines. This divergence highlights the unique challenges and opportunities within the Chinese tech market. Similarly, mixed results were observed among Taiwanese, Japanese, and Korean stocks, indicating varied investor sentiment across the region.

MARKET CONDITIONS:

As we look forward to November, with upcoming events like China's CPI and the PCOB Interest Rate Decision, market volatility is expected to continue. The historical volatility figures for ATI, with a 21-day range at 24.10%, suggest significant price movements could be on the horizon. The projected range between $2,809 to $3,229 indicates a notable fluctuation window for the index.

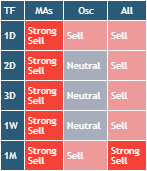

Investors and traders should consider the weekly support levels at $2,470 to $2,566 and resistance levels at $4,283 to $4,439 for strategic planning. These levels, identified through advanced analysis tools like AutoUFOs®, provide crucial insights for navigating the unpredictable Asian tech market. The neutral conditions indicated by technical oscillators further emphasize the need for a balanced approach in trading strategies.

Broader Market Dynamics

The performance of the ATI is intricately linked to the broader Asian tech industry, which is currently navigating a complex landscape of regulatory changes, evolving consumer trends, and technological advancements. This sector is a significant contributor to the global economy, and its fluctuation can impact various markets worldwide.

Understanding these dynamics and effectively analyzing market trends are essential for successful trading in this sector. Tools like AutoClimate and AutoUFOs® can provide traders with the necessary insights to make informed decisions amidst the market's inherent volatility.

Conclusion

In summary, the ATI presents a challenging but potentially rewarding opportunity for market participants. The mixed performance across different regional components underscores the need for a nuanced understanding of the Asian tech sector. As the market braces for key economic events in November, traders equipped with sophisticated analysis tools and a keen understanding of the market dynamics will be better positioned to navigate these turbulent waters.

BRENT

Summary:

Mini Brent Crude Futures (BM) experienced a turbulent October, marked by geopolitical tensions and strategic decisions by major oil producers. The month started on a weaker note, with BM losing around $9 from September's closing, touching a monthly low at $83.44. However, it managed a modest recovery, reaching $93.79, before settling at $85.02 by the month's end.

The geopolitical conflict in the Middle East, particularly between Israel and Gaza, raised concerns about potential disruptions in oil production and its ripple effect on the global energy market. Additionally, OPEC+'s decision to extend production cuts, led by Saudi Arabia and Russia, added another layer of complexity to the oil market dynamics.

A key factor influencing oil prices was the reported increase in OPEC oil production in October, combined with weakening manufacturing data from China, hinting at possible reduced oil demand.

MARKET CONDITIONS:

As we head into November, the oil market remains sensitive to geopolitical developments and production decisions by major oil players. The upcoming OPEC+ Joint Ministerial Monitoring Committee (JMMC) meeting on November 26th will be closely watched for any new developments impacting global oil supply.

The historical volatility of BM, with a 21-day range at 49.58%, suggests a high potential for price fluctuations. The projected price range between $73 to $97 over the next 30 days underscores this volatility. Traders and investors might consider the weekly support levels at $72.51 to $75.41 and resistance levels at $92.65 to $98.57 as pivotal points for their strategic decisions.

These levels, determined using advanced analytical tools like AutoUFOs®, can offer valuable insights for market participants to plan their market entries and exits. The current sideward trend of the weekly chart, fluctuating between $72 and $99, indicates a market that is yet to find a clear direction.

Broader Market Context

The performance of BM is closely tied to global economic conditions, energy policies, and geopolitical events. The oil market is a barometer for global economic health and is affected by various factors including supply-demand dynamics, technological advancements in energy production, and environmental policies.

Navigating this complex market requires an in-depth understanding of these factors and a keen eye on global developments. Tools like AutoClimate and AutoUFOs® can be instrumental for traders in identifying key trends and making informed decisions in a market known for its unpredictability.

Conclusion

In conclusion, the Mini Brent Crude Futures market presents a challenging landscape for November, influenced by geopolitical events, OPEC+ decisions, and global economic indicators. For market participants, employing sophisticated tools and staying updated with the latest market trends will be crucial in navigating the volatile oil market effectively. As the market braces for the upcoming JMMC meeting, the decisions made here could significantly impact the future direction of oil prices.

Please note that this report provides an overview of the market conditions and does not constitute financial advice. It is recommended that individuals seek the guidance of a qualified financial professional before making any investment decisions.

Please feel free to join our ˲tradewithufos community, we provide comprehensive trading courses and trading apps.

Apps for market analysis and trading:

www.tradewithufos.com/apps

FREE forever membership for everyone:

www.tradewithufos.com/membership

TRADDICTIV · Research Team