Introduction to the Butterfly Spread Strategy

The Butterfly Spread strategy stands as a paragon of precision and risk management in the world of options trading. Characterized by its fixed risk and capped profit potential, this strategy is ingeniously designed to thrive in markets where minimal movement is anticipated. Its relevance is particularly pronounced in the volatile energy sector, offering traders a sanctuary of stability amidst the tumultuous waves of the CL WTI Crude Oil Futures Options market. This strategy not only encapsulates the essence of strategic foresight but also exemplifies the meticulous calibration required for successful execution.

Understanding CL WTI Crude Oil Futures Options

The WTI (West Texas Intermediate) Crude Oil Futures, a benchmark in the global oil market, presents a labyrinth of volatility and opportunity. Traded fervently on the NYMEX, these futures are a testament to the market's liquidity and transparency. The advent of Micro WTI Crude Oil Futures has revolutionized access to this market, democratizing it for individual traders through lower capital requirements and enhanced position management. This segment underscores the criticality of understanding these instruments for anyone venturing into the energy trading domain.

Strategic Framework for Constructing a Butterfly Spread

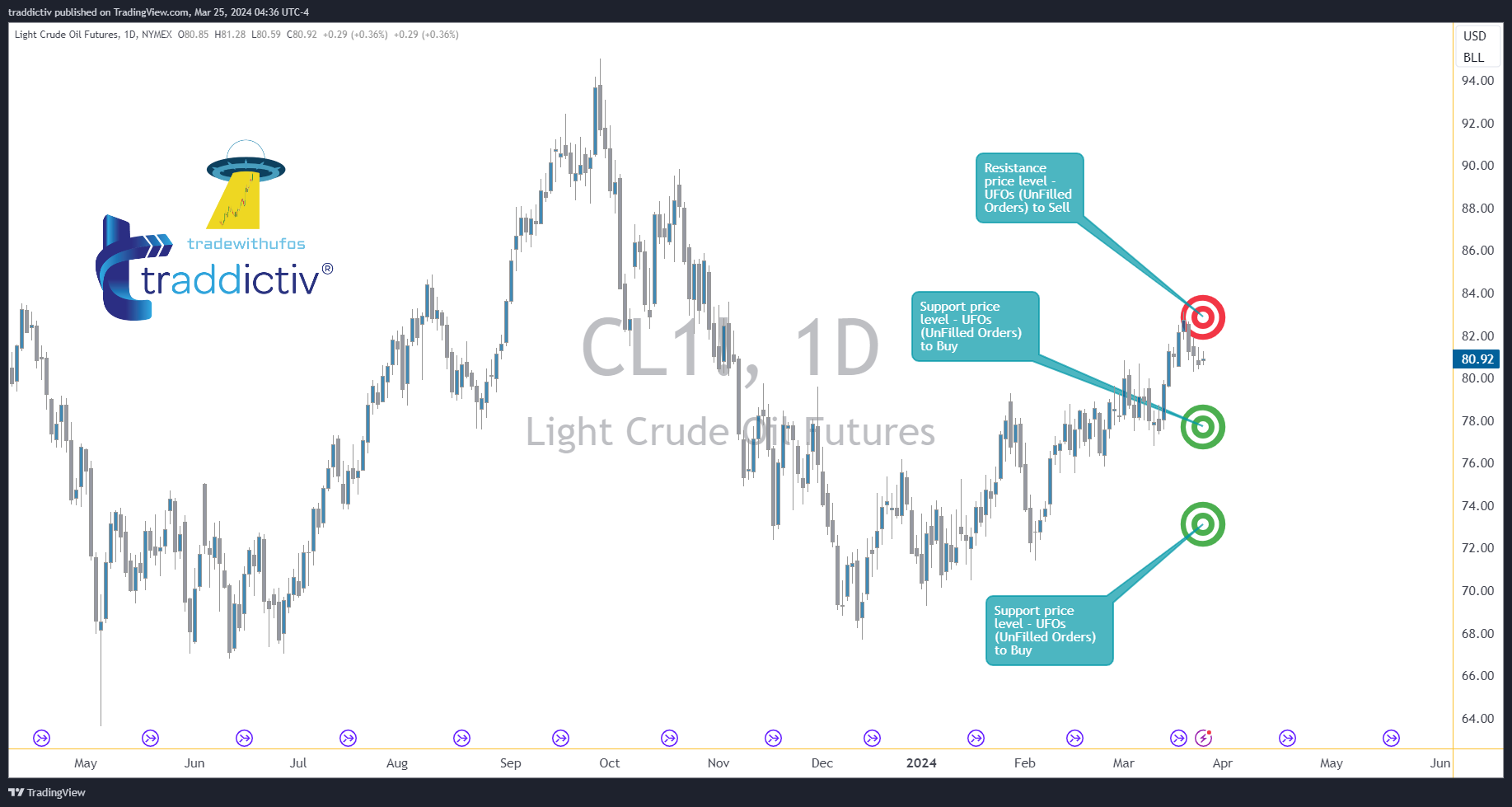

Constructing a Butterfly Spread is akin to assembling a Swiss watch; precision is paramount. This strategy's foundation is laid by strategically selecting one in-the-money (ITM) option, selling two at-the-money (ATM) options, and purchasing one out-of-the-money (OTM) option, all with the same expiration. The artistry of this setup lies in leveraging tools like AutoUFOs® to identify potent strike prices, informed by underlying support and resistance levels. This section delves into the minutiae of strike selection, expiration determination, and premium management, illuminating the path to establishing a robust Butterfly Spread.

Advantages, Risks, and Strategic Considerations

While the Butterfly Spread is distinguished by its defined risk and profit potential, it demands an acute understanding of its advantages and inherent risks. This strategy's allure lies in its capacity to harness market equilibrium; however, its beauty is not without thorns. The complexity and commission costs associated with its multiple legs can deter novices. Yet, for the informed trader, leveraging market analytics tools like AutoClimate™ can provide invaluable insights into timing and market conditions, enhancing strategy execution.

Market Scenarios: Analysis and Adaptation

The Butterfly Spread's performance is intrinsically linked to the market's whims. Stability and slight fluctuations are its allies, volatility its nemesis. This section explores various market scenarios, employing case studies and performance simulations to showcase the strategy's adaptability. It emphasizes how real-time data and analytics, accessible through platforms like TradingView, are indispensable in navigating the CL WTI Crude Oil Futures Options market with agility and insight.

Execution Mastery: From Theory to Practice

Translating the theory behind the Butterfly Spread into actionable strategy requires mastery over execution. This involves identifying optimal entry points, making timely adjustments, and adhering to a disciplined exit strategy. The narrative here is enriched with practical tips and real-world applications, highlighting the pivotal role of continuous market analysis and the strategic use of advanced trading tools in refining execution tactics.

Risk Management: Beyond the Basics

The final cornerstone of successful options trading is advanced risk management. This segment delves deep into strategies that go beyond basic principles, advocating for a technology-driven approach to safeguard investments. It discusses how comprehensive market data and analytics serve as the bulwark against unforeseen market shifts, ensuring traders can navigate the tumultuous waters of the commodities market with confidence.

Conclusion: Strategic Edge in Options Trading

In the quest for a competitive edge in options trading, the Butterfly Spread emerges as a beacon of strategic depth and informed decision-making. This concluding section reflects on the journey through the intricate landscape of CL WTI Crude Oil Futures Options trading, emphasizing the imperative of continuous education, market vigilance, and the judicious application of trading tools like AutoUFOs® and AutoClimate™.

Want to read an expanded article with multiple TradingView charts that illustrate the application ? Check it out here: tradingview.com/u/traddictiv

- Follow us and Boost the TradingView Published Idea if you like it 👌

Want to know more about AutoUFOs® and AutoClimate™ ? Check it out here: tradewithufos.com/apps

TRADDICTIV · Research Team