Introduction

E-mini Nasdaq Futures, mirroring the tech-centric Nasdaq 100 Index, offer traders key insights into technology trends and broader market dynamics.

Essentials of Nasdaq Futures

- Point Value: Each point movement translates to $20.00, providing significant leverage.

- Trading Hours: Available for trading nearly 24/7, accommodating global market participants.

- Margin Requirements: Approximately $8,700, necessitating careful risk management.

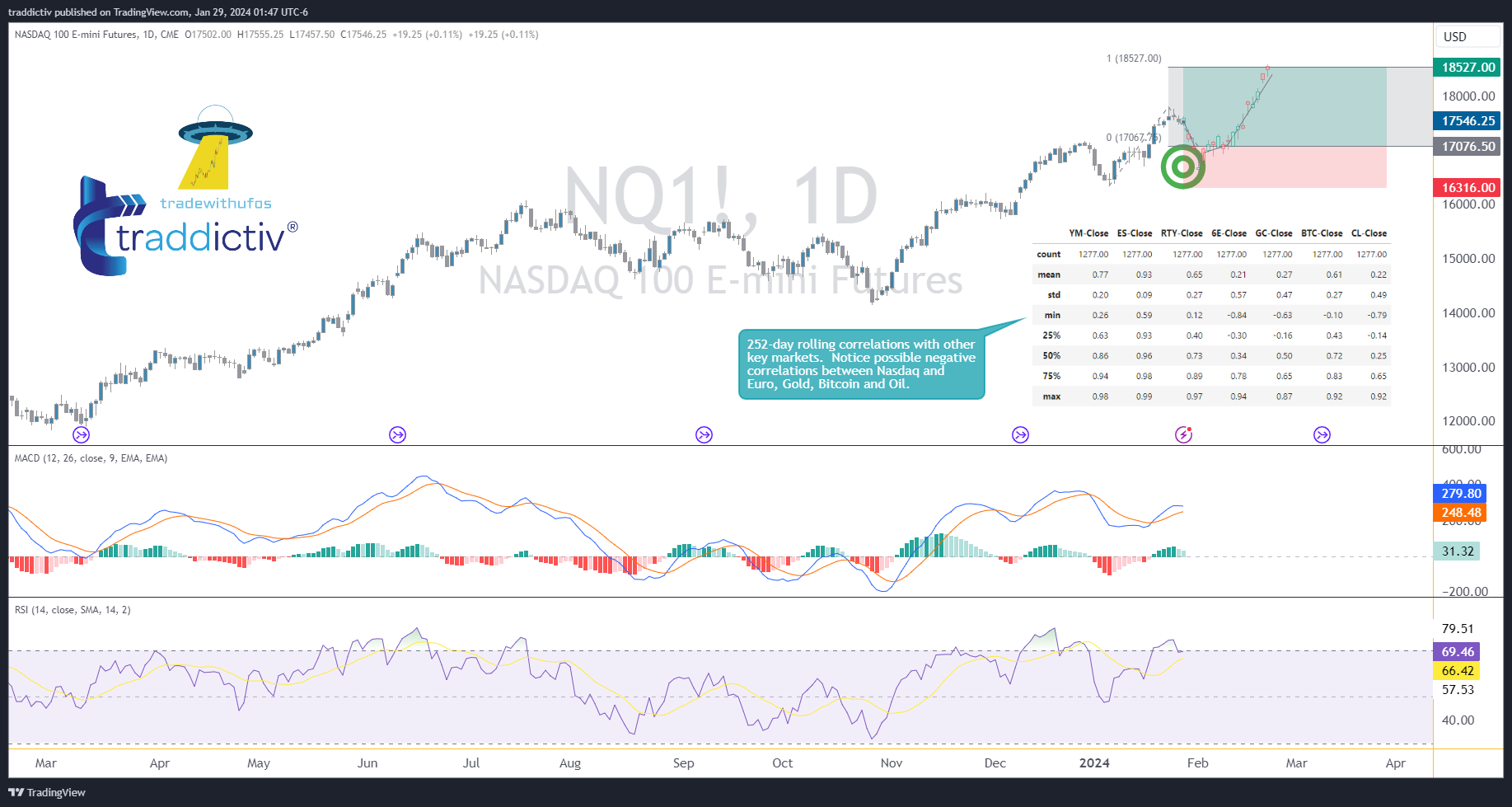

Market Correlation Dynamics

- E-mini Nasdaq Futures often show inverse correlations with Gold, Euro Futures, and Light Crude Oil, presenting unique trading opportunities.

- Utilizing tools like AutoUFOs® can reveal strategic price regions, enhancing decision-making.

Technical Analysis: Decoding Market Trends

Technical analysis is the backbone of strategic trading in E-mini Nasdaq Futures. The Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are vital tools for this purpose. The MACD, a trend-following momentum indicator, consists of two lines (the MACD line and the signal line) and a histogram. A bullish signal is indicated when both lines are above the zero line, suggesting an uptrend and potential long positions. Conversely, lines below the zero line may signal a bearish trend.

The RSI, oscillating between zero and 100, measures the speed and change of price movements. An RSI above 70 often signals an overbought condition, hinting at a potential pullback, while a reading near 30 might indicate a price rise and a buying opportunity. Using these indicators helps traders identify key market entry and exit points, aligning with risk-reward parameters.

Trade Plan: Strategic Execution

Developing a strategic trade plan is crucial for capitalizing on E-mini Nasdaq Futures. Entry points can be identified using bearish setups in negatively correlated markets, like Euro Futures, indicating potential bullish momentum in Nasdaq Futures. The MACD and RSI readings can guide these decisions, particularly looking for bullish price reactions in specific ranges where Buy UnFilled Orders (UFOs) may be present.

Setting realistic target prices is based on historical movements and resistance levels in the Nasdaq market. Stop-loss orders are vital for minimizing losses, placed at levels invalidating the initial trade hypothesis. A healthy reward-to-risk ratio (e.g., 2:1) ensures balanced trading. Understanding point values and contract specifications is also essential for accurate profit and loss calculations, considering micro contract options for risk management.

Continuous market monitoring and flexibility in strategy adjustment are key to implementing this plan, aiming to maximize profits while managing risks in line with individual trading styles and risk tolerances.

Risk Management

- Implementing stop-loss orders and considering hedging strategies are key to mitigating risks.

- Adapting strategies in response to market changes, supported by analytical tools like AutoUFOs®, enhances trade effectiveness.

- Avoiding undefined risk exposure is crucial for sustainable trading success.

Conclusion Trading E-mini Nasdaq Futures requires an integrated approach, blending detailed market analysis with strategic execution and effective risk management. The incorporation of advanced tools like AutoUFOs® offers additional clarity and precision in navigating this dynamic market.

Want to read the expanded article on TradingView ? Check it out here: tradingview.com/u/traddictiv

- Follow us and Boost the TradingView Published Idea if you like it 👌

Want to know more about AutoUFOs® and AutoClimate™ ? Check it out here: tradewithufos.com/apps

TRADDICTIV · Research Team